Auto-computation of Skills Development Levy (SDL) via CPF EZPay

Auto-computation of Skills Development Levy (SDL) via CPF EZPay

-

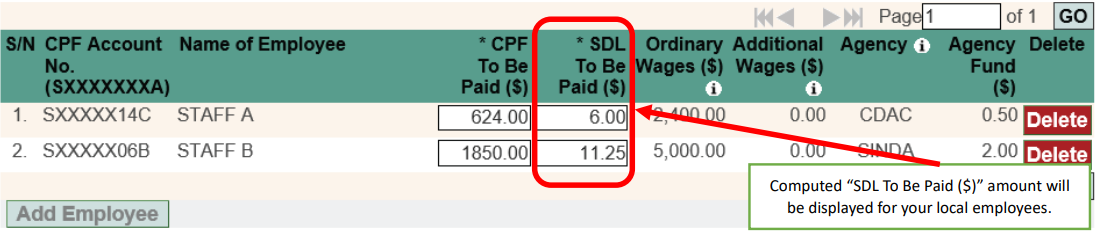

Employers who contribute SDL via CPF EZPay, can get their SDL payable automatically calculated for their local employees in the relevant month based on their declared wage.

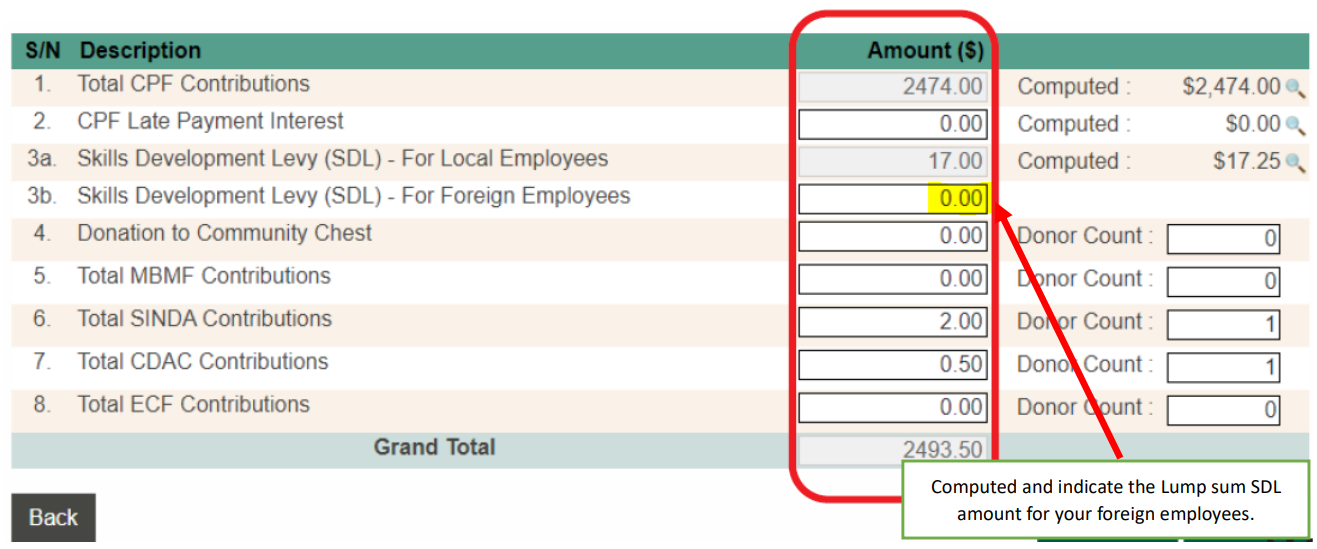

For foreign employees, employers can use SSG’s SDL online calculator to work out the actual SDL contribution and indicate the lump sum payment under the “Skills Development Levy (SDL) - For foreign employees” section in the same transaction.

-

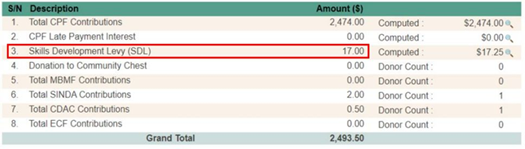

No, you should indicate the actual amount payable under the “Skills Development Levy (SDL) – For foreign employees” field when submitting the details. CPF EZPay will sum up the total SDL amount payable (for both your local and foreign employees) and the final amount will be rounded down to the nearest dollar at the confirmation and payment page.

-

The bonus pay-outs or allowances should be added to the monthly salary and employers should use the total sum to determine the SDL for their employees. For example, if the employee’s salary for Dec 2023 is $3,000 and the bonus paid in Dec 2023 is $1,000, SDL should be calculated based on $4,000 ($3,000 +$1,000). In this scenario, SDL payable is $10 ($4,000 x 0.25%).

-

We strongly encourage the use of the auto-computation feature which improves your convenience in making SDL contributions.

To disable the auto-computation during the online submission, employers can edit the “SDL To be Paid” field or set the SDL payable option to “No” for certain employees who do not require SDL contributions.

Thereafter, please submit a declaration of your computed monthly SDL payable excluding these exempted employees for the relevant months via GoBusiness.

Please retain all supporting documents as per your declaration as SkillsFuture Singapore (SSG) may request for them subsequently.

-

Employers can make back-payments for SDL directly by logging in to GoBusiness. Head to Levy > Skills Development Levy (SDL) and click on the Make Payment/Declaration button. You may then follow the steps as indicated in our SDL Payment and Declaration (gobusiness.gov.sg) on “How do I make my SDL payment on Gobusiness?”.

Please note that as an employer who is liable to pay SDL, you should keep a proper payment record as SSG may conduct audits.

If you have received a Notice of Assessment (NOA) or mailer from SSG, do make payments for SDL via GoBusiness by selecting the period (for example start date as 01/01/2023 and end date as 31/12/2023) indicated in the NOA or mailer.

-

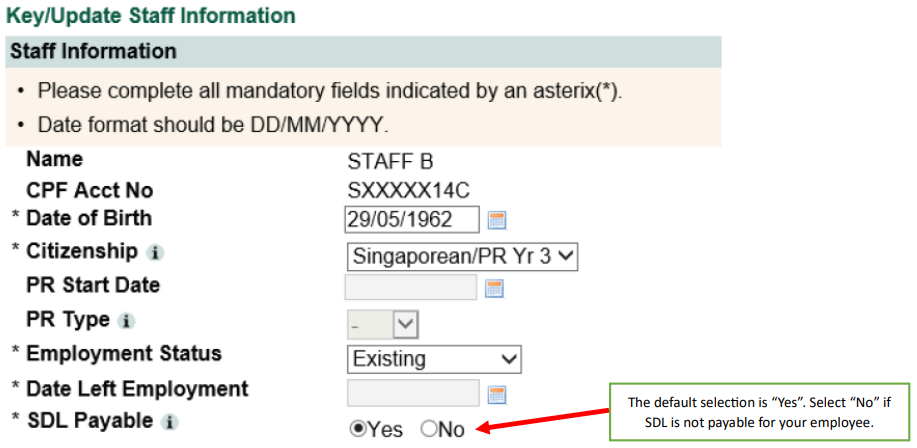

For employees whom SDL is not required, please select No at the SDL Payable field during your CPF submission (see picture below).

Please submit a declaration of your computed monthly SDL payable excluding these affected employees for the relevant months via GoBusiness.

Please retain all supporting documents as per your declaration as SSG may request for them subsequently.

-

Employers can refer to the user guide on using CPF EZPay. For technical asssistance, please contact CPF Board at 6220 2340 or write to them at CPFB.