Overview

Getting Started

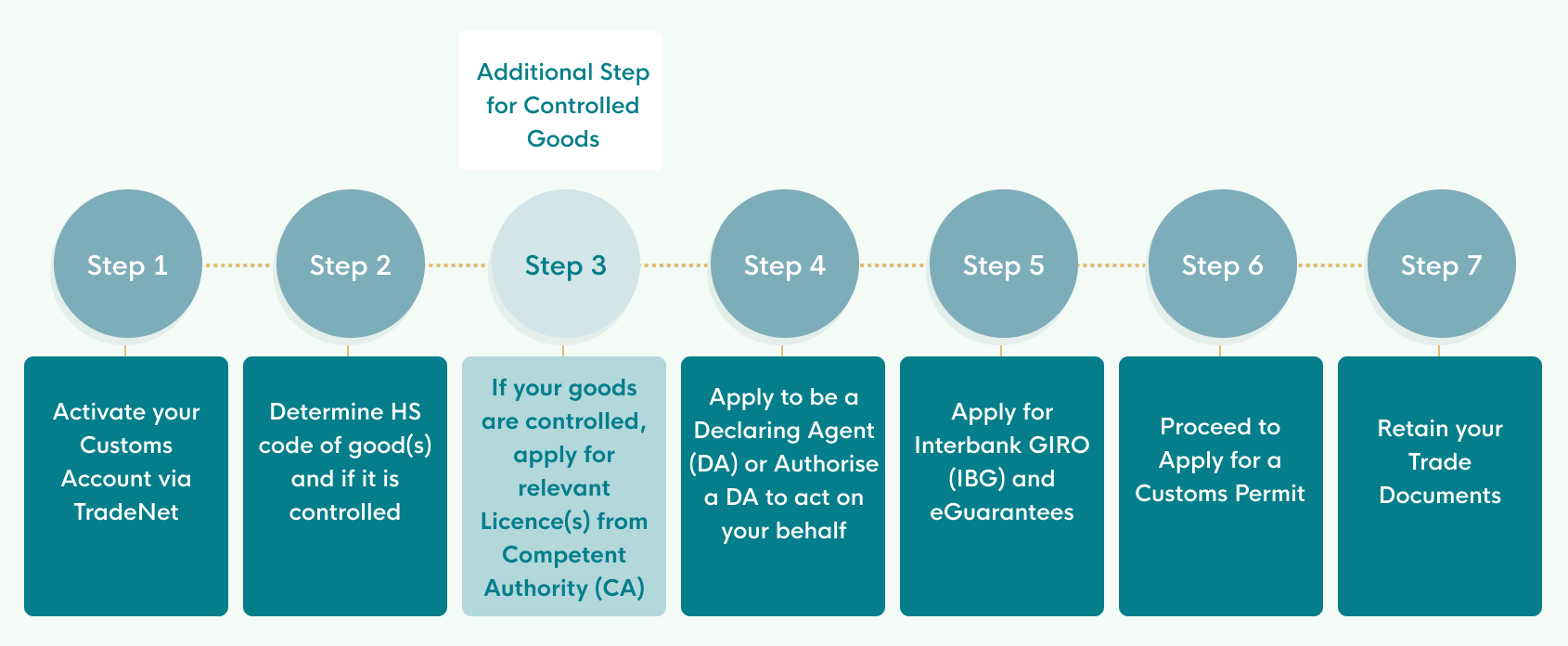

If your business entity wishes to engage in import, export and/or transhipment activities in Singapore, you will need to complete the steps listed below.

Launch of HS/CA Product Code Checker

For import, export and transhipment

This e-service allows you to find out the Harmonised System (HS) code for the type of product you are importing, exporting or transhipping. If your product is controlled, you will get the Competent Authority (CA) product code, CA contact details and recommended licence(s).

Key steps to start your import, export and/or transhipment journey

Step 2: Determine HS code of goods

A Harmonised System (HS) code is required for all goods moving in and out of Singapore. Some goods are controlled and may be subjected to additional requirements.

Step 3: Apply for relevant licences

Use the HS/CA Product Code Checker to find out the recommended licences.

Step 4: Register a Declaring Agent

Only DAs may apply for import/export for a Customs Permit.

Step 5: Apply for Interbank GIRO (IBG) and eGuarantees

Payment of duties, taxes fees and any other charges are deducted via IBG.

eGuarantees may not required for regulatory requirements and revenue protection purposes.

Step 6: Apply for Customs Permit

A customs permit is generally required for importing, exporting and transshipment of goods in and out of Singapore.

Retain your Trade Documents

You are required to retain all the relevant supporting documents relating to the goods.